Now Reading: Apple’s Desperate Move: Trump Tariffs Force iPhone Production Shift

-

01

Apple’s Desperate Move: Trump Tariffs Force iPhone Production Shift

Apple’s Desperate Move: Trump Tariffs Force iPhone Production Shift

Apple’s Emergency Plan to Escape Trump’s China Tariffs

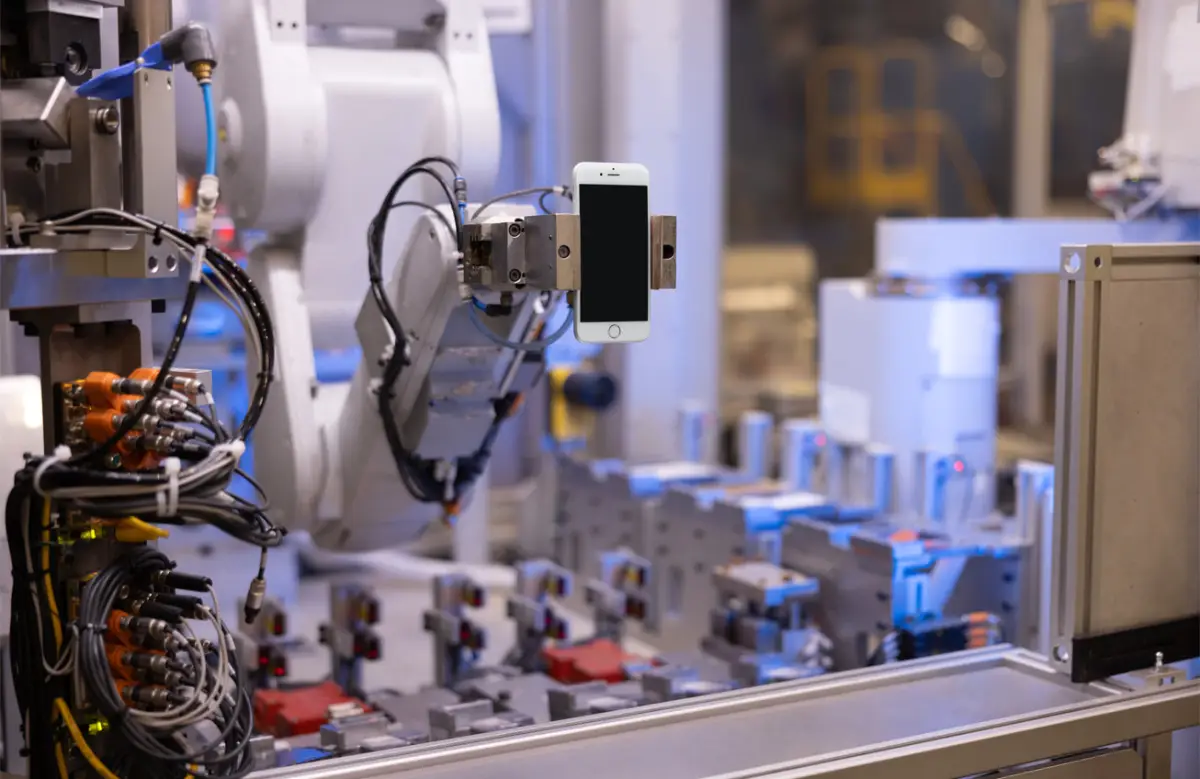

In a dramatic shift that’s sending shockwaves through the tech industry, Apple is urgently ramping up iPhone shipments from India to the United States. The tech giant is scrambling to dodge the crushing impact of Donald Trump’s latest trade crackdown, which slaps a staggering 54% tariff on Chinese imports.

This emergency rerouting represents a clever—if temporary—workaround while CEO Tim Cook attempts to negotiate an exemption from the hefty new duties. Industry insiders note this isn’t Cook’s first tariff tango with Trump; he successfully secured special treatment during the former president’s first term.

The $300 Problem: How Trump’s Tariffs Could Make Your Next iPhone Much Pricier

The financial implications are eye-popping. Analysts estimate Trump’s China tariffs could add a whopping $300 to the manufacturing cost of an iPhone 16 Pro—a device that already costs Apple approximately $550 to produce. With profit margins potentially under serious threat, it’s no wonder Cook is seeking alternative solutions.

The math is brutal: the cost of producing an iPhone 16 with 256GB could balloon from around $580 to $850 under the new tariff structure. This explains why Apple shares have experienced their worst three-day plunge in nearly 25 years, with stock values dropping by a devastating 20 percent.

India to the Rescue: Apple’s Strategic Production Shift

The India solution isn’t just clever—it’s potentially transformative. While Chinese imports face Trump’s 54 percent levy, goods from India are hit with a comparatively lower 26 percent tariff. This significant difference creates a compelling case for Apple’s rapid pivot to Indian manufacturing.

According to The Wall Street Journal, which first reported the shift, Apple now plans to produce an impressive 25 million iPhones in India this year. Even more interestingly, up to 10 million units originally destined for local Indian consumers will be redirected to meet American demand.

Bank of America analysts suggest this strategic redirection could potentially satisfy about half of US iPhone demand—a remarkable achievement for a production shift executed under emergency conditions.

Beyond Tariffs: Apple’s Long-Term India Strategy

While the current shift may be crisis-driven, Apple’s relationship with Indian manufacturing isn’t new. The tech giant has been gradually expanding its production presence in India since 2017—not merely as a tariff-avoidance tactic, but as part of a broader strategic vision.

This diversification serves multiple purposes: reducing Apple’s heavy dependence on China, mitigating geopolitical risks, and establishing a stronger foothold in India’s rapidly expanding smartphone market, which represents one of the company’s most promising growth opportunities.

The American iPhone Dream: Why US Production Remains Elusive

Despite Trump’s stated goal that tariffs will encourage domestic manufacturing by increasing the price of foreign products, experts remain highly skeptical about the prospects of large-scale iPhone production on American soil.

Barton Crockett, senior research analyst at brokerage firm Rosenblatt Securities, minced no words when speaking to the Wall Street Journal: moving iPhone production to America would be a “massive, mammoth undertaking.” The financial reality is even more sobering—assembly costs that hover around $30 in China would skyrocket tenfold if production moved to the US.

“It’s not clear you can make a competitively priced smartphone here,” Crockett bluntly stated. The fundamental challenge extends beyond assembly—Apple would still need to import the raw materials used to manufacture its devices, creating additional layers of cost and complexity.

What This Means for Your Next iPhone Purchase

For consumers, the ultimate question remains: will iPhone prices rise? While Apple hasn’t announced any immediate pricing changes, the financial pressure is undeniable. The company typically maintains consistent pricing tiers across generations, potentially forcing them to absorb some of the increased costs at the expense of profit margins.

The upcoming iPhone 16 launch, expected this fall, will likely provide the first real glimpse of how these trade tensions translate to consumer pricing. Industry watchers should pay close attention to both retail pricing and any subtle changes in storage configurations or feature sets that might help Apple manage cost pressures.

The Bigger Picture: Tech Supply Chains in a New Trade Reality

Apple’s predicament highlights the broader challenges facing global tech companies as trade tensions intensify. After decades of optimization for efficiency and cost, supply chains built primarily in China now face unprecedented political and economic pressures to diversify and relocalize.

While India represents an immediate solution for Apple, the company’s supply chain remains overwhelmingly concentrated in China, where relationships with manufacturers like Foxconn have been cultivated over decades. The depth of this manufacturing ecosystem—with specialized tooling, trained workforces, and intricate supplier networks—can’t be replicated overnight in any location.

As this high-stakes economic drama continues to unfold, one thing remains clear: the smartphone in your pocket is increasingly becoming a product of global trade politics as much as technological innovation.